Table of Contents

An RV insurance quote is an estimate provided by insurers detailing the cost of covering the Recreational Vehicle (RV). The insurance quote protects the RV from various risks, including accidents, theft, and damage. Having the right coverage ensures peace of mind while traveling or living in the RV.

Factors influencing RV insurance quotes include the RV’s type, age, usage, location, and the desired coverage. For instance, motorhome insurance costs more than camper insurance due to the higher value and complexity of motorhomes.

Accurate information is essential when requesting a quote. Provide details like the RV’s make, model, year, condition, and intended use. Any customizations, such as solar panels or upgraded appliances, must be disclosed to ensure the quote reflects the correct coverage.

Comparing RV insurance quotes from different providers allows owners to evaluate cost and coverage options. Ensure that the coverage limits and exclusions match the needs. Negotiate with insurers to adjust terms or explore add-ons to tailor the policy further.

Coverage variations occur depending on the insurer and the motorhome or camper insurance type. Regularly update the policy if the RV’s usage, location, or value changes to maintain adequate protection.

What is an RV Insurance Quote?

An RV Insurance Quote is an estimate from an insurer detailing the cost of insuring an RV. The insurance quote is based on factors like the type of RV, its usage, and the desired coverage. RV owners use the quote to plan their insurance costs. For example, a quote varies based on whether the RV is used for full-time travel or occasional vacations. The quote helps compare different insurance providers and coverage options. It reflects the specific needs of the RV owner and provides insight into potential premium costs.

How to Get a Quote for RV Insurance?

To Get a Quote for RV Insurance, follow the five steps listed below.

- Provide Complete RV Details. Give accurate information about the RV, including its make, model, age, and value. Insurers use the data to assess the risk and determine the coverage options

- Specify the RV Usage. Clearly state how the RV is used for full-time living, occasional travel, or seasonal use. Usage impacts the premium and coverage options.

- Share Personal and Driving History. Include detailed personal information, such as the driving history and any claims. It helps insurers evaluate the actual risk level and adjust the quote accordingly.

- Compare Multiple Insurance Providers. Get quotes from different insurers to find the best coverage at the most competitive price.

- Review Coverage Options. Carefully review what is included in the quote. Ensure the coverage meets the specific needs, such as liability, collision, and comprehensive coverage.

What Factors Affect the RV Insurance Quote?

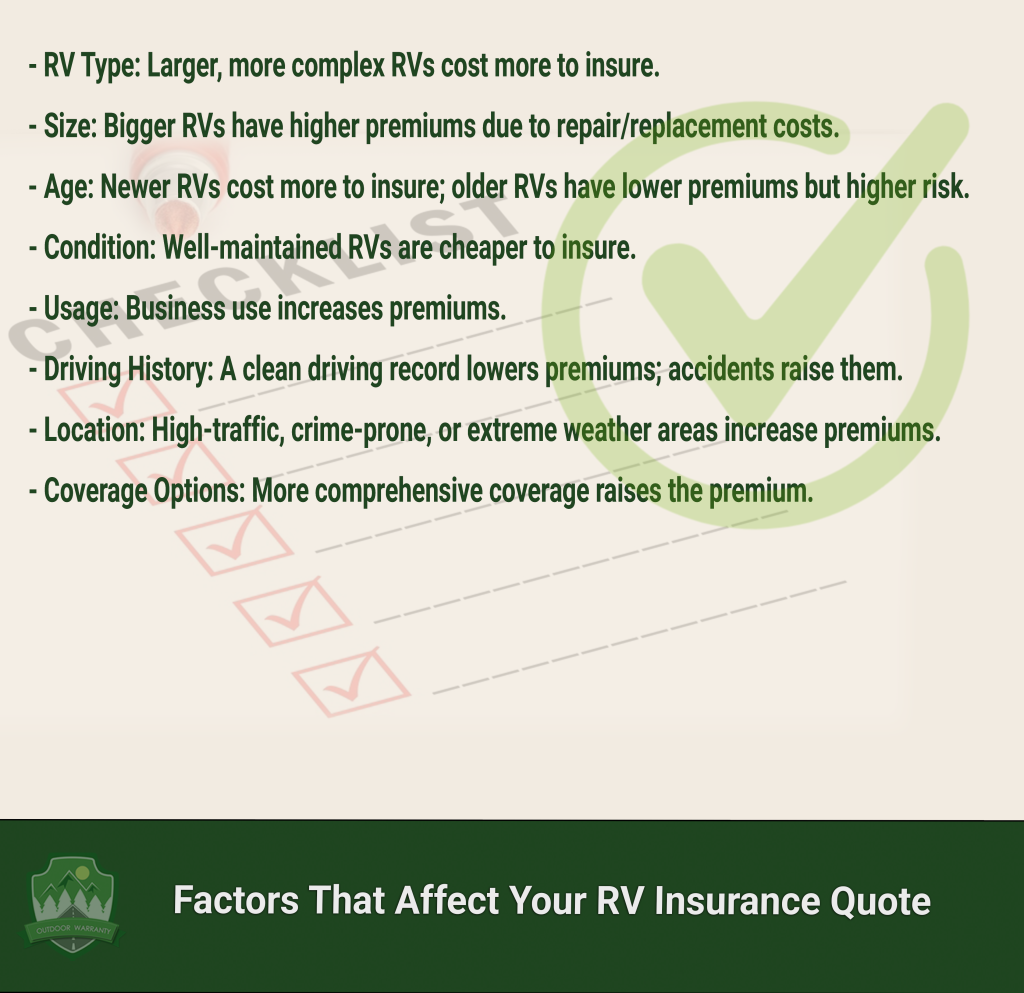

The Factors that Affect the RV Insurance Quote are listed below.

- RV Type: The type of RV, such as motorhomes, trailers, or campers, affects the premium. Larger, more complex vehicles cost more to insure due to higher repair and replacement costs.

- Size: The size of the RV influences the quote. Bigger RVs have higher premiums because they are more expensive to repair or replace.

- Age: The age of the RV plays a role in the quote. Newer RVs cost more to insure due to their higher value, while older RVs have lower premiums but are more prone to mechanical issues.

- Condition: The condition of the RV impacts the quote. Well-maintained RVs are less risky to insure, leading to lower premiums than RVs in poor condition.

- Usage: The premium affects whether the RV is used for personal or business purposes. Business use increases premiums due to the increased risk of accidents and liability.

- Driving History: An individual’s driving history influences the quote. A clean driving record lowers premiums, while a history of accidents or traffic violations increases the premium.

- Location: The location of the RV is stored and driven, which affects the premium. Areas with high traffic, crime rates, or extreme weather result in higher insurance costs.

- Coverage Options: The type and level of coverage chosen to impact the premium. Comprehensive coverage, which covers more risks, increases the quote compared to basic liability coverage.

How do RV Insurance Quotes Vary for Different RV Types?

RV Insurance Quotes vary for Different RV Types by the coverage needs specific to each type. Motorhomes require more extensive coverage due to their larger size, more complex systems, and higher value. These vehicles need liability and comprehensive coverage, which results in higher premiums.

Towable trailers and fifth wheels have lower insurance costs compared to motorhomes. These RV types require less coverage and are mainly focused on liability and physical damage protection. They pose a lower risk for accidents or mechanical issues since they are not self-powered, thus reducing the premium.

Camper vans fall somewhere in between. They are similar to motorhomes but are smaller and more affordable. Their premiums are lower than motorhomes due to their reduced size and lower repair costs, but they require full coverage.

The RV types directly impact risk levels and premium costs. Larger and more complex RVs, like motorhomes, have higher repair and replacement costs, leading to higher insurance premiums. Smaller RVs, like towable trailers, are less expensive to insure because their risks are lower regarding accident potential and repair expenses.

Are Online RV Insurance Quotes Reliable?

Yes, Online RV insurance quotes are reliable when obtained from reputable providers. Trusted insurers use accurate algorithms and data to generate quotes based on the details provided. However, discrepancies occur if the information entered is incomplete or inaccurate, leading to incorrect premium estimates. Hidden fees appear in the final policy if not all coverage options and conditions are fully disclosed during the quoting process. Review the terms carefully and ensure all relevant information is provided for an accurate quote.

How to Compare RV Insurance Quotes from Multiple Providers?

To compare RV Insurance Quotes from Multiple Providers, follow the six steps listed below.

- Standardize Coverage Options and Limits. Ensure that the coverage options and limits are the same across all quotes. Comparing quotes with varying coverage leads to misleading conclusions. Standardizing helps evaluate the cost relative to similar protection.

- Compare Premium Costs. Compare the premium costs from different providers once coverage is aligned. A lower premium is attractive but results in less coverage or higher out-of-pocket expenses in the event of a claim.

- Assess Customer Service. Evaluate the quality of customer service provided by each insurer. Good customer service ensures that questions are answered quickly and that support is available during emergencies.

- Review Claims Handling Process. Investigate how each provider handles claims. A provider with a fast and efficient claims process saves time and reduces stress in the event of an incident, which is a crucial aspect of RV insurance.

- Look for Additional Benefits. Check for extra benefits or discounts offered by insurers, such as roadside assistance, policy bundling, or discounts for safe driving. These add value to the policy and influence the overall cost-effectiveness.

- Research Provider Reputation. Consider the reputation and financial stability of each insurer. Look for reviews, ratings, and any industry accolades. A reliable provider with a solid reputation ensures financial security and peace of mind.

What Information is Needed to Obtain an RV Insurance Quote?

The information needed to obtain an RV Insurance quote is the RV make, model, year, condition, usage, storage location, personal driving history, and any customizations. Provide the RV’s make, model, and year to determine its value and repair costs. The condition of the RV is crucial for assessing its risk level. Information about how the RV is used, whether for personal or business purposes, impacts the quote significantly. Knowing where the RV is stored, whether in a garage or outside, helps estimate the risk based on location.

Personal driving history, including any accidents or violations, is essential for determining the premium. Customizations or modifications to the RV, such as upgraded interiors or enhanced equipment, affect the policy price as they influence the vehicle’s value. Tips for gathering the information include reviewing the RV registration and maintenance records. Verify the driving history with the motor vehicle department, and list any modifications or upgrades made to the RV. Having all these details ready ensures an accurate and quick quote process.

How much can you Save by Bundling RV Insurance with Other Policies?

You can save up to 25% by bundling RV insurance with other policies. Insurers offer bundling discounts when combining RV insurance with home, auto, or other types of coverage. Bundling reduces premiums by consolidating policies under one provider, simplifying payments, and improving loyalty benefits.

For example, receive a 10% to 25% discount on each policy when combining the RV insurance with auto and home insurance. The exact savings depend on the insurer and the types of policies bundled. Insurance providers offer additional discounts for bundling multiple vehicles or home policies with RV insurance. Check the specific terms and conditions, as the discount requires maintaining continuous coverage and having a claims-free history.

Do RV Insurance Quotes Cover Full-Time RV Living?

What are the Common Add-Ons in an RV Insurance Quote?

Yes, RV Insurance quotes cover full-time RV living. Full-time RV living requires specialized insurance coverage. Full-time RV insurance includes additional coverages such as liability protection, personal belongings coverage, and medical benefits, unlike standard RV policies. These coverages reflect the increased risk of living in the RV as a primary residence rather than using it for occasional trips. Full-time RV living coverage comes with higher premiums due to the increased liability and the potential for more frequent claims. The cost increase accounts for the higher likelihood of accidents, wear and tear, and the need to cover personal property inside the RV.

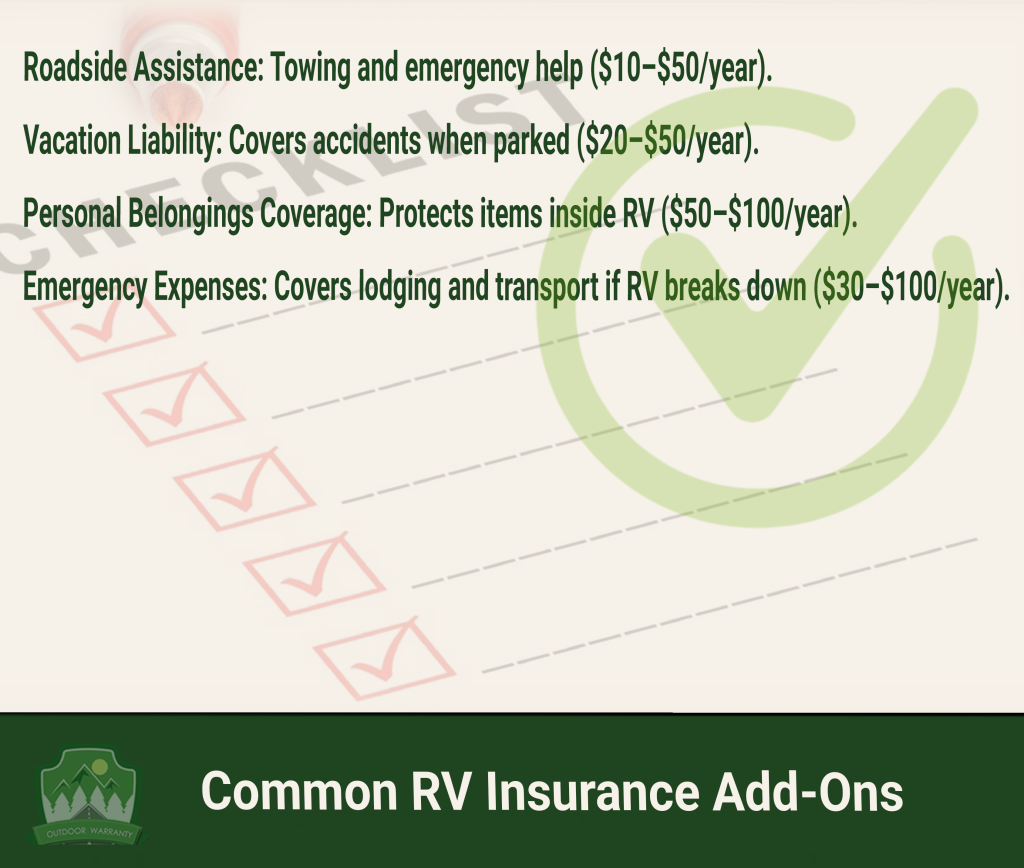

The Common Add-Ons in an RV Insurance Quote are listed below.

- Roadside Assistance: Roadside Assistance provides help if the RV breaks down while on the road. It includes services like towing, flat tire changes, fuel delivery, and lockout assistance. The add-on costs an extra $10 to $50 per year.

- Vacation Liability: Vacation Liability covers accidents or injuries while the RV is parked and used as temporary living space, such as during a vacation. It protects against accidents that happen while camping or in RV parks. The cost ranges from $20 to $50 annually, depending on the provider.

- Coverage for Personal Belongings: Personal belonging coverage protects personal items inside the RV, such as electronics, clothes, and camping gear, against theft or damage. The add-on costs an additional $50 to $100 per year, depending on the value of the items.

- Emergency Expenses: Coverage for emergency expenses pays for temporary lodging, meals, and transportation if the RV is inoperable due to a covered event, like a breakdown or accident. The coverage adds $30 to $100 per year to the policy cost.

Can RV Insurance Quotes Include Roadside Assistance?

Yes, RV insurance quotes can include roadside assistance. Insurance providers offer roadside assistance as an optional add-on to RV insurance quotes. The coverage includes services like towing, tire changes, fuel delivery, and lockout assistance. It helps RV owners in case of emergencies while on the road, providing peace of mind during travels. The additional cost for roadside assistance is affordable, adding a small fee to the annual premium.

What is the Difference Between RV Insurance and RV Extended Warranty?

The Difference Between RV Insurance and Extended RV Warranty is in the type of protection they provide and their coverage scope. RV insurance protects against risks like accidents, theft, and liability, while an Extended RV Warranty covers mechanical and electrical failures after the manufacturer’s warranty expires.

RV insurance covers damage from accidents, weather events, theft, and liability for injuries or property damage caused by the RV. The cost varies based on coverage limits and type of RV but runs on an annual basis. It provides coverage for a set period, usually one year, with the option to renew.

An Extended RV Warranty covers specific mechanical and electrical failures, such as engine issues, transmission problems, or appliance malfunctions. The warranty extends the protection offered by the manufacturer’s warranty and is purchased for a fixed duration, 3 to 7 years. The cost depends on the RV’s age, model, and the level of coverage selected.

Pros of RV insurance include comprehensive protection from various risks and legal liabilities. The cons include its cost and potential exclusions for certain types of damage. Pros of an Extended RV Warranty include coverage for expensive repairs, but the cons involve limitations in the scope of coverage and potential high deductibles. RV insurance protects against external risks, while an Extended RV Warranty covers internal mechanical failures, with different costs, coverage, and durations for each.

How Often should you Update Your RV Insurance Quote?

You should update your RV insurance quote annually or whenever there are significant changes, such as relocating, upgrading the RV, or changing its usage. Updating the quote regularly ensures that the coverage remains adequate and reflects any changes in the RV or circumstances. For example, moving to a new location or using the RV full-time impacts premium costs and coverage needs. Keeping the quote current helps avoid overpayment for coverage that no longer aligns with the situation.

Are RV Insurance Quotes Higher for New RVs?

Yes, RV insurance quotes are higher for new RVs. New RVs have higher premiums due to their higher value and cost to repair or replace. Insurers factor in the cost of the vehicle when determining premiums, and newer RVs require more extensive coverage to protect their investment. Used RVs have lower premiums but need additional coverage for maintenance risks or potential mechanical issues. The age and condition of the RV influence the cost of the policy.

Do RV Insurance Quotes Include Coverage for Customizations or Upgrades?

Yes, RV insurance quotes include coverage for customizations or upgrades. Coverage for customizations or upgrades, such as solar panels or awnings, requires an additional rider or results in higher premiums. Standard RV insurance policies do not include customizations automatically, so adding special features increases the coverage cost. Document all upgrades to ensure they are covered in the event of damage or loss. The documentation helps insurers assess the value of the upgrades and adjust the policy accordingly.

How to Calculate the True Cost of an RV Insurance Quote?

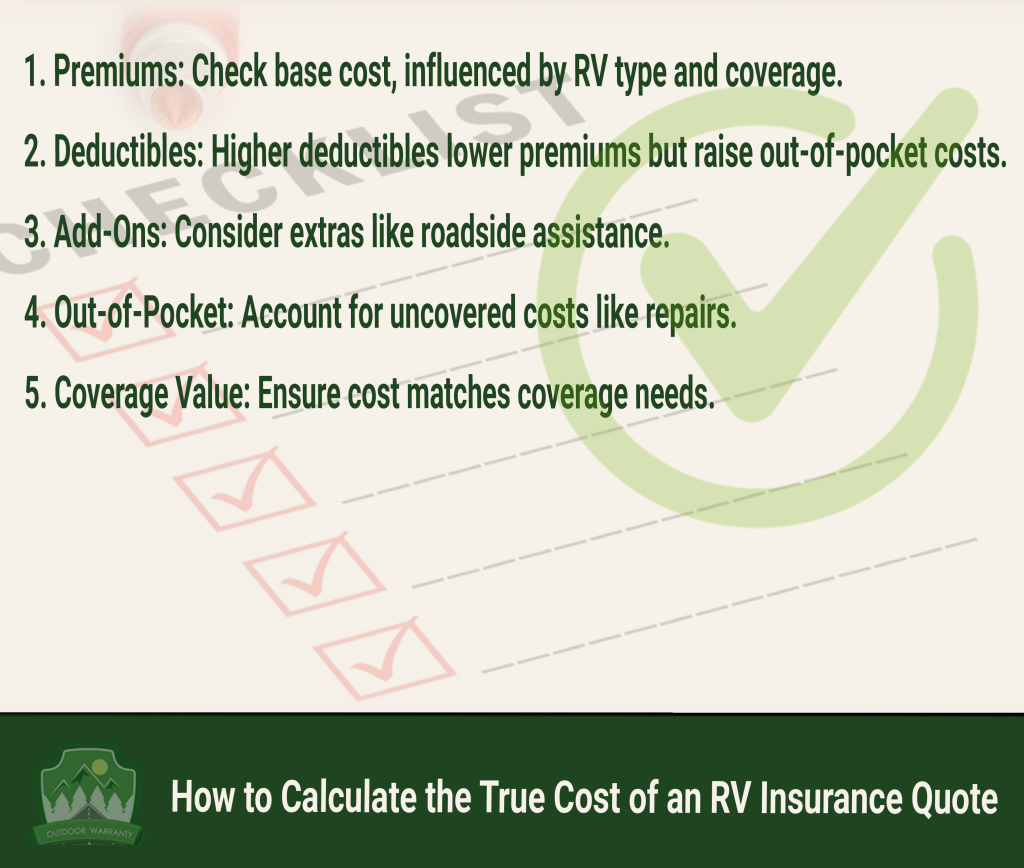

To Calculate the True Cost of an RV Insurance Quote, follow the five steps listed below.

- Review Premiums. Look at the annual premium, which is the base cost of the insurance policy. The primary cost varies depending on the RV type, coverage limits, location, and driving history.

- Consider Deductibles. Check the deductible amount for each coverage type. A higher deductible lowers the premium, but it means higher out-of-pocket expenses in case of a claim. Ensure the deductible amount is manageable for the budget.

- Account for Add-Ons. Include additional coverage options, such as roadside assistance, Pop-up Camper Insurance, or personal belongings coverage. Add-ons increase the policy’s cost but offer valuable protection depending on the needs.

- Factor in Out-of-Pocket Expenses. Consider any additional costs that arise, such as repairs not covered by insurance or expenses for temporary lodging if the RV is inoperable. These expenses affect the total cost of ownership beyond the quoted price.

- Compare Against Coverage Value. Evaluate the total cost of the policy against the coverage provided. Ensure that the protection offered is adequate for the RV and its use. A low-cost policy is attractive but lacks sufficient coverage, exposing owners to larger financial risks.

Are RV Insurance Quotes Higher in Certain States?

Yes, RV insurance quotes are higher in certain states. Location significantly affects RV insurance quotes due to traffic density, crime rates, and natural disaster risks. States with higher traffic volume or increased crime rates have higher premiums because the risk of accidents or theft is greater. Areas prone to natural disasters like hurricanes, wildfires, or flooding result in higher insurance costs due to the increased likelihood of damage.

For example, Florida and California have higher RV insurance premiums due to high traffic density and natural disaster risks. Michigan or Maine have lower premiums due to lower traffic volume and fewer natural disaster threats.

What should you Look for in an RV Insurance Quote Policy?

The things you should look for in an RV Insurance Quote Policy are listed below.

- Coverage Limits: Review the limits to ensure they align with the needs. Coverage limits determine the maximum amount the insurer pays for a claim and provide sufficient protection for the RV’s value and liabilities.

- Exclusions: Understand the exclusions in the policy. These are specific situations or damages that are not covered by the insurance. Knowing the exclusions helps prevent surprises when filing a claim.

- Add-Ons: Evaluate available add-ons like roadside assistance, personal belongings coverage, or Pop-up Camper Insurance. These add-ons provide additional protection for specific needs but increase the premium.

- Claims Process: Assess the insurer’s claims process. It must be straightforward and efficient and provide support during emergencies. A complicated or slow claims process leads to frustration when owners need the most help.

- Customer Reviews: Consider providers with strong customer reviews and ratings. Positive feedback on customer service, claims handling, and satisfaction indicates that the insurer is reliable.

- Flexible Policy Options: Look for flexible policy options that allow adjustments based on the needs. Insurance providers offering customizable coverage or the ability to modify the policy mid-term ensure the insurance remains suitable as circumstances change.